By: Michael Hudock

When you go to a restaurant, there are several things you expect your waiter to say to you.

What would you like to drink?

Are you ready to order?

How is everything?

Can I interest you in one of our desserts?

But recently, while dining in one of my favorite restaurants, I was unprepared for what my waiter said to me.

“I want to pick your brain a little bit.”

It wasn’t what I expected to hear. But the waiter – a very nice young man – explained that he knew I was a financial advisor and had wanted to talk to me for some time. So, I asked him what was on his mind. He told me he wanted to ask about investing and how to get started. He had been doing a little research, and he had some questions.

“But first,” he said, “I want to do some more research. Then I’ll ask you my questions the next time I see you.”

A few weeks later, I returned to the restaurant. I was happy to see the young man would once again be my waiter.

“Well?” I asked him. “Where are you? Have you started investing yet?”

“No,” he said. “I still need to do some more research.”

I put down my menu. Now it was my turn to surprise him.

“No,” I said firmly. “No more research. You have to get started. You’re wasting valuable time.”

***

There’s a quote that pops up on the internet from time to time that’s often attributed to Albert Einstein.

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

I don’t know if Einstein really said that, but if he didn’t, he should have. Because it’s true! The “miracle of compound interest,” as it’s often called, is every bit as powerful as Einstein’s own theory of relativity…and it plays an even bigger role in our daily lives.

Compound interest is interest that accumulates both from your initial investment and all previously accumulated interest. (In other words, interest on your interest!) Think of it like a snowball that gets exponentially bigger as you roll it along the ground, because more snow is being added to the snow that’s already there.

Compound interest is the reason I urged that young waiter to stop “doing research” and start investing now. Of course, educating yourself is never a bad thing. The problem is delay. Because the earlier a person starts investing, the more time their interest can compound upon itself, earning them substantially more money than if they had waited.

Here’s an example of the power of compound interest. Let’s call that waiter Ben. Imagine Ben invests $2,000 a year – just $166 per month – from age 19 to age 27. Let’s also assume that Ben’s investments yield an average return of 10% over the course of his lifetime. Even if he didn’t save or invest anything else during that time, he would still end up with $1 million by the time he was 65…thanks to compound interest.

On the other hand, imagine Ben waited until age 27 to start investing $2,000 per year. This time, he invests for the next 38 years with the same rate of return. How much do you think he’ll have earned by age 65?

$800,000.

You read that right. Just by investing earlier – and despite the fact he only saved for eight years in total – Ben would have earned $200,000 more by age 65 than if he had started later and invested for longer.

That is why I urged my waiter friend not to, well, wait. (Yes, pun intended.)

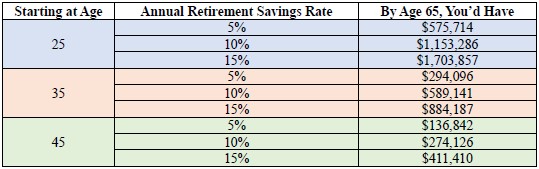

Here’s another way to illustrate the power of compound interest. Imagine a person who earns $74,580 per year. (According to the U.S. Census Bureau, this was the median household income in 2022.) This time let’s assume a lower rate of return – just 6%. Here’s how much they would earn if they started investing 5, 10, or 15% of their annual income at various ages.

See how dramatically the numbers in the far-right column decrease with age? A person who started investing 15% of their income at age 25 would earn over $1.2 million more than someone who started at 45.

Now, to be clear, it’s never too late to start investing. Here at Hudock Capital, we’re thrilled whenever we see a person begin saving for their long-term goals no matter what age they are.

But if you’re like most people, one of your goals is probably to ensure your family’s long-term financial security. I imagine that’s especially true for your children and/or grandchildren. This is a terrific goal, and not just because you love your kids and want the best for them. The more financial independence your children have, the less likely you will need to support them financially as adults. (In other words, the less likely you will need to dip into your own retirement savings.)

As a financial advisor, it’s extremely common for a client to come to me and say, “I want to help my kids accomplish all of their dreams.” Or, “I want to ensure my kids won’t have to live with me in their thirties. What’s the best way to do that?”

My guess is they usually expect me to mention some obscure financial product or fancy strategy. Instead, I tell them the same thing I told that waiter, and the same thing I’m telling you now: Teach them to start investing early and often. Don’t wait – start now! Whether it’s from a weekly allowance, babysitting, walking dogs, that first summer job at the local coffee shop, or the start of their career after college, teach them to invest a portion of their income every single month. If they’re older, show them how to set up their checking account so that funds get automatically invested with each paycheck. Make it a habit they don’t even have to think about.

Recently, I’ve recommitted to doing exactly this with my kids. So, you can imagine how proud it made me when my teenage son informed me that he had decided to set aside 75% of his lawn mowing money for his big goals down the road.

(I may have gotten a little too excited when he told me. A few days later, I tried to start a conversation with his friends about their goals and objectives when all they really wanted to do was ride motorbikes. I can’t help it — I love helping people achieve their dreams and I’m always trying to help more!)

The point is, let the power of compound interest start working for your family as soon as possible. It’s the single best thing you can do to secure your family’s financial future…and it will contribute a great deal to securing your own. And if you ever need any assistance with teaching your loved ones how to invest, set up accounts, or anything else, please don’t hesitate to reach out. We are always happy to help!

As for that waiter? I’ll be returning to the restaurant soon. My hope is that he’s started investing. I hope, too, that he’ll see how excited I am to leave a tip.

— Michael Hudock