In Observance of Labor Day Hudock Capital Group LLC will be closing at 4:00 PM Friday, August 30th and remain closed Monday, September 2nd 2024

Letters category: Archives

Categories

Fundamentals Drive Technicals

Written by RiverFront Investment Group. Reprinted with permission from RiverFront Investment Group. Redistribution is prohibited.

Shockingly Weak Labor Report; “Risk Off” Trades will Dominate

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Beginning to Buy Energy Stocks

Written by RiverFront Investment Group. Reprinted with permission from RiverFront Investment Group. Redistribution is prohibited.

Yellen Ready to Hike; GDP Up but Productivity Still Lags

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Fed Call: Hike With Dovish Language, Dot Plot Lower

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Summer Correction in Context

Written by RiverFront Investment Group. Reprinted with permission from RiverFront Investment Group. Redistribution is prohibited.

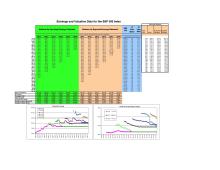

Dr. Siegel’s comments regarding the Valuation and Sentiment Indicators charts found below. September 1, 2015.

“The fall in earnings estimates (a prime reason for my bear call 3 weeks ago) has accelerated. 2015 operating earnings for the S&P 500 fell more than $3 over the past month to $111.64, more than a dollar under 2014 earnings, and reported earnings fell by nearly $3 to $100.59, also below 2014 levels. As late as April of this year analysts were expecting over $117 fo…r operating and over $110 for reported earnings. Such a slide is unprecedented outside of a recession. 2016 earnings estimates are down more modestly.

Investor sentiment has turned sharply negative, falling to more than 16% below trend. This is the lowest level since the Spanish and Greek debt crises of 2010 and 2011, and is very near the level where markets have often snapped back sharply. We may now be witnessing the ingredients of a market bottom.”

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Fed Rate Hike Now Very Likely and Not Yet Factored Into Markets

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

We Added Stocks, Reduced Cash

Written by RiverFront Investment Group. Reprinted with permission from RiverFront Investment Group. Redistribution is prohibited.

Fed Rate Hike Still in Play; Stocks Likely to Mark Time until Decision

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.