Letters category: Letters

Categories

The American Creed

In 1881, a young boy named William Tyler Page left home, bound for Washington, D.C. Page knew little about politics, having spent most of his young life working twelve hours a day in a paper-bag factory. But he had just been accepted as a courier in the House of Representatives.

He was only thirteen years old.

For Page, this was no mere summertime job. It was not intended to be a mark on his future resume. It was the beginning of 61 years of unheralded public service.

As a teenager, Page spent his days delivering messages, running errands, and keeping the House organized. Couriers like him were expected to work hard, be reliable, and always conduct themselves in a non-partisan manner. Page must have enjoyed the work because he never left Washington. Instead, he rose through the ranks, supervising the younger couriers as he got older. He became such a trusted fixture in the Capitol that both parties turned to him for advice on congressional procedure.

Having participated firsthand in every aspect of lawmaking, Page knew all there was to know about how to actually get work done. Congress knew it, too. In 1919, he was elected Clerk of the House of Representatives. It was his responsibility to preserve order and decorum on the House floor at all times, keep official records, and oversee the election of the Speaker. Page served as Clerk throughout the 1920s, when the Republican Party was in the majority. When the Democrats took over in 1931, a special position of Emeritus Clerk was created specifically for him, showing just how respected he was on both sides of the aisle. His dedication, expertise, and non-partisanship became a byword in the Capitol building. And when he passed away in 1942, both parties agreed to adjourn in his honor.

But Page was most known for being the author of the American Creed.

In 1917, shortly after the U.S. entered World War I, the nation was gripped by patriotic fervor. Inspired by what he was seeing, Page began thinking about his own patriotism and what the country meant to him.

As someone who spent nearly every day of his life seeing “how the sausage gets made,” one might expect Page to have had a cynical view of our nation. After all, many Americans often feel this way. The headlines always seem to be full of mudslinging, scandals, and petty politics. As children, we learn in school about the heroic deeds, monumental speeches, and pivotal moments that make up our country’s history. But as adults, the magic of patriotism can get lost under an onslaught of negativity.

In life, though, it’s the things we labor for the most that we tend to love the most. And William Page loved his country.

So, Page decided to write his thoughts and feelings down. What inspired him. What drove him. What made his country special. What made his country worth serving. His goal was to craft a simple but thorough statement of what it means to be an American…and why being an American has meaning.

It went like this:

I believe in the United States of America as a government of the people, by the people, for the people; whose just powers are derived from the consent of the governed; a democracy in a republic; a sovereign Nation of many sovereign States; a perfect union, one and inseparable; established upon those principles of freedom, equality, justice, and humanity for which American patriots sacrificed their lives and fortunes.

I therefore believe it is my duty to my country to love it, to support its Constitution, to obey its laws, to respect its flag, and to defend it against all enemies.

After writing these words, Page submitted them to a nationwide patriotic contest. Immediately, his statement caught on. Anyone who reads it can recognize the words. They are the words of the Declaration of Independence. Of the Preamble to the Constitution. Of Daniel Webster’s legendary “Liberty and Union” speech. Of Lincoln’s Gettysburg Address. They are an amalgamation of every argument for democracy. A summation of this crazy, grand experiment. They are the philosophical pillars on which our country rests.

Page’s words won the contest. They were recited by schoolchildren and added to many naturalization ceremonies. And in 1918, they were passed by the House of Representatives – the same body Page had devoted his life to – as the American Creed.

These days, it’s easy to have a cynical view of our country. Easy to feel like this experiment in democracy has become an exercise in frustration. But nobody said this experiment was going to be easy. Only that it would be worth it.

Because the words in the American Creed are still true today.

In just a few days, we will celebrate our nation’s birthday. As we do, we hope we can all personally reflect on the American Creed and what it means. Our nation is still a government of the people, by the people, and for the people. Our union may not always be perfect, but it will always be inseparable. And it is still based on the principles of freedom, equality, justice, and humanity. Principles that do not dull with the passage of time, but like stars in the sky, become ever brighter as they age.

We will also reflect on the achievements of our ancestors and the opportunities of our descendants. We will ponder our own respective loves and beliefs. May we also recommit — each and every one of us — to love, support, and defend our country. May we reaffirm the words of the American Creed.

Happy Independence Day!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

The noise can be deafening. It seems to come from everywhere, all the time. It can cause headaches, frustration, even anxiety. Sometimes, you wish you could turn it off altogether.

No, we’re not referring to whatever music the kids are listening to these days. We’re referring to the noise surrounding the upcoming presidential elections.

Election season is one of the most important aspects of our political system, but there’s no doubt that getting through it can be stressful. All of us, at some point, will wonder things like, “What if my preferred candidate doesn’t win?” “Who is my preferred candidate, anyway?” “Does so-and-so really mean this?” “Did so-and-so really say that?” “What’s fact and what’s fiction?”

But one thing you shouldn’t have to stress over is how the elections will impact the markets. There are a lot of misconceptions that spring up every four years about what presidential contests might mean for your portfolio. Most of these cause investors to worry unnecessarily. As your financial advisor, it’s our job to help you feel confident in your financial future, not anxious. So, in this letter, let’s do a brief dive into three misconceptions about election season and the markets.

The first misconception is that presidential elections lead to down years in the markets. It’s understandable why we might feel this way. When we look back at past elections, the first things we remember are probably the controversies, uncertainties, and negativity. Election years feel volatile in our minds and memories, usually because there’s so much drama and so much at stake.

But statistics prove this misconception is a myth. Since 1944, there have been twenty presidential elections. In sixteen of those, the S&P 500 experienced a positive return for the year.1 In fact, the median return for presidential election years is 10.7%.1 Of the four election years that saw a negative return, two did occur in this century – in 2000 and 2008 – but on both occasions, the nation was either entering or in the midst of a significant recession.

Now, we do sometimes see increased volatility in the months leading up to an election. If we just look at how the S&P 500 performed from January through October in a presidential election year, the median return drops to 5.6%.1 That’s not bad, but it is nearly 50% lower. This suggests the uncertainty over who will triumph in the election – and the debate over what each candidate’s policies will mean for the economy – does tend to have at least some effect. Then, as the victor is announced and the picture becomes a little clearer, volatility tends to subside, and investors move on to other things. So, in that sense, election season does matter, but nowhere near what the media may have you believe. Elections are just one of the many ingredients in the gigantic stew that is the stock market…and they’re far from the most important.

The second misconception is that if one candidate wins, the markets will plummet. This narrative is, frankly, driven by pure partisanship. The fact of the matter is that the markets have soared under both Republican and Democratic presidents. Naturally, they’ve occasionally soured under both parties, too. Since 1944, the median return for the S&P 500 in the year after a presidential election is 9.8%.1 Since 1984? The median return rises to over 24%.

The reason for this is because of that gigantic stew we mentioned. You see, the markets are driven by the economy more than by elections. By the ebb and flow of trade, the law of supply and demand, by innovation and invention, by international conflict and consumer confidence. And while the president does have an influence on all this, it’s just one of many, many influences. As a result, the markets are far more likely to be affected by inflation and whether the Federal Reserve will cut interest rates than by the election.

When you think about it, the markets are like life. The course our lives take isn’t determined by one gigantic decision, but by the millions of small decisions we make every day. The same is true for the markets. We don’t know about you, but we find this comforting.

The third misconception is that we have no control over any of this, and thus, no control over what happens to our portfolio.

It’s true. We can’t dictate who the president will be. We can’t determine how the markets will react. But what we can control is what we will do. And that, is a mighty power indeed.

There’s a reason we began this letter by referencing noise. As investors, one of the keys to long-term success is filtering out the noise and focusing on what really matters. You see, the goal of all political campaigns – and the media that covers them – is to create noise. That’s because noise provokes emotions. Fear. Anxiety. Anger. A greater emotional response leads to more clicks, more views, more shares, more engagement…and, yes, more money. It’s understandable why campaigns and the media want these things. But what we must guard against is letting those emotions drive our financial decisions. Emotions promote the urge to do something – buy, sell, get in, get out, take on more risk, less risk, you name it. They prompt us to make short-term decisions to alleviate what is, when you think about it, a short-term concern.

A presidential term lasts four years. But the goals you have saved for, and the time horizon you have planned for, lasts much longer than that. That’s why our investment strategy is built around the long-term. It’s designed to help you not just tomorrow, or next month, but years and years from now. It’s designed so that the president of the United States, as important as he or she may be, is only a passing mile-marker on the much longer road to your goals and dreams.

So, as we draw near to another election, remember: Tune out the noise. Remember these misconceptions and avoid them. And most of all, remember that our team is here to answer your questions and help you however we can. Please let us know if there is ever anything we can do.

Have a great summer!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 “Election year market patterns,” ETRADE, us.etrade.com/knowledge/library/perspectives/daily-insights/election-stock-patterns

With fathers being honored this month, it got me thinking about this question:

How many dads have I had?

I am lucky enough to say that I have had more than one father. I have a wonderful relationship with my dad. But I also have shared important moments with men who temporarily filled a fatherly role when, for whatever reason, mine could not. These men were there when I needed them. They helped shape who I am today.

Not everyone can say they’ve had a father who was present in their lives. And others may say the father they did have was not worthy of the title. But I think it’s important to recognize those who willingly served as father figures when they were needed most. The times in my life that role has been held by a teacher, a coach, a neighbor, a friend’s dad…you know those types. We can recognize them across the course of our lives by how we have looked to them for guidance, wisdom, support, and protection.

Recently, I read a story about such father figures that really resonated with me. In celebration of Father’s Day, I hope this story inspires you to reflect on how powerful an effect the presence a father figure can have.

***

Within the first three weeks of the school year at Southwood High School in Louisiana, 23 students were arrested, expelled, or suspended due to fighting. As a result, a heavy police presence began to take root at the school, which only served to make the students feel less safe. So, the principal held an emergency meeting with parents to discuss solutions on what could be done.

The group bounced ideas off each other for a few hours without success. How could they ensure their kids’ safety while at the same time making the school a relaxed and enjoyable place to be?

Then, one father had an idea: Who better to solve this problem than us?

Five fathers volunteered to be a rotating presence. They called themselves “Dads on Duty.” Dads started by going to the school in a group to monitor the hallways. It expanded when they started talking to the students and making sure they got to class on time. They even shared a few (terrible) dad jokes.

Students didn’t welcome them with open arms right away, but they warmed up to them. But then the “Dads” went above that call of duty, by investing in the students’ success. They actively engaged in discussions with the students on entrepreneurship and alternatives to gang culture. They inspired these kids by focusing on their goals and helping out with home life. Even with those who were not their own flesh and blood.

This group of five eventually became 40. All volunteer their time to cover daily shifts. As one of these founding fathers explained, “Because there are some folks who don’t have a father or don’t have such a great relationship with their father, and it’s our goal to let them see what the right relationship with a male figure is supposed to look like”1

Just having these dads on campus made a huge difference with both the students and faculty. The fighting and misbehavior declined – and student morale rose. More and more, the students, teachers, and parents bonded with and supported each other.

Fights have been almost nonexistent since these dads went ‘on duty’. It has created such a huge impact in the community that the mayor wants to implement the program city-wide. And the “Dads on Duty” want to expand across schools all over Louisiana and then go nationwide.

***

What a difference a dad makes. While my own father holds a significant place in my heart, I know that other men I’ve encountered have also shaped my journey through their influence.

I think the lesson for all of us is, it doesn’t take a lot of effort to make a difference in someone’s life. In this case, it was just a few people who consistently gave time, a lot of love, and (maybe) some well-placed dad jokes.

And while I will be spending time this Father’s Day honoring my own dad, I will also be spending some of that time acknowledging those men who were “Dads on Duty” during a critical moment in my life – and who played a role in shaping the person I am today.

I hope that you will do the same.

On behalf of everyone on my team, I wish you a happy Father’s Day!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

1 “Fights erupted at a high school in Louisiana. So these dads took matters in their own hands,” CNN,

https://www.cnn.com/2021/10/29/us/dads-on-duty-louisiana-school-cec/index.html

They came down in the dark.

It was just after midnight when the villagers of Sainte-Mere-Eglise awoke to the sound of planes, gunfire, explosions…and the sight of American paratroopers landing in their gardens. Despite the hour, despite how groggy they were, they knew in an instant what was happening. It was June 6, 1944. D-Day. The long-promised invasion of France had begun.

But the men of the 82nd and 101st Airborne divisions had no idea what was going on. They came down in the dark, scarcely able to see. They came down scattered and isolated. They came down without equipment or supplies except what they could carry on their backs. They came down without communication equipment except for their own voices, which they could hardly use for fear of alerting snipers. They came down without many of their comrades, whose planes had crashed or been driven miles off course. They came down without any certainty of where they were or where to go.

But they came down. And the one thing they did come down with was courage.

Quickly, little knots of soldiers, often from different units, banded together. Ducking snipers’ bullets, they felt their way through the countryside, blocking roads, cutting telephone wires, and seizing bridges as fast as they could before the main German forces realized what was happening. But then, when they entered the town square of Sainte-Mere-Eglise, they stopped short. There, in the trees, hung the bodies of their comrades, parachutes tangled in the branches. Shot before they could even reach the ground.

For several minutes, all the stunned soldiers could do was stand there. Staring – as one veteran later put it – “filled with a terrible anger.”

Then, an officer came forward. Slowly, Colonel Edward Krause pulled from his pocket a faded, threadbare American flag. A flag that had already seen action on the island of Sicily and been raised triumphantly over the city of Naples. Earlier, Krause had promised his men that, “before dawn of D-Day, this flag will fly over Sainte-Mere-Eglise.”1 The paratroopers followed as he walked to the town hall, went to the flagpole, and raised the Star-Spangled Banner over the first town to be liberated in France.

They came down scattered and isolated. They came down with little equipment or supplies. They came down in the dark. But they came down. And all through the day and into the next, as they fought to hold the village, the little American flag flying over Sainte-Mere-Eglise never did.

Off the coast of Normandy, the crew of the U.S.S. Corry knew they were a target. The plane that was supposed to lay a smoke screen for them had been shot down. Nevertheless, they knew they had to get as

close to the beach as possible. As the lead destroyer for the entire invasion, their job was to destroy as much of the German fortifications as they could so that the infantry could land on Utah Beach.

The crew of the Corry knew they were a target. Still, their commander, George Hoffmann, sailed to within 1,000 yards of the beach and dropped anchor. Soon, the sailors had destroyed one German battery, but another seemed especially intent on sinking them. Realizing they could no longer press their luck, Hoffmann gave the order to move back. But the water was so shallow, it wasn’t safe to simply turn around. For the next several minutes, the sailors exerted every muscle and called upon every ounce of experience they had to keep the ship moving forward, then back, left, then right, stopping and starting…all while the ship’s guns fired so hot, deckhands had to keep hosing them down. Finally, the Corry managed to turn…but then their luck ran out.

The explosion was so huge, Hoffmann thought “the ship had been lifted by an earthquake.”1 The Corry had been hit. Hard. Water poured into the hull. A foot-wide crack ran across the main deck, leaving both ends of the ship pointed upwards. The Corry was turning into a sinking steel coffin. But through it all, the Corry’s guns kept firing…until Hoffmann gave the order: Abandon ship.

Still, still, the crew of the U.S.S. Corry knew they were a target. As the sailors raced to board rafts and lifeboats, the German artillery kept firing. As the senior officer, Hoffmann waited until everyone was off the ship, then dived into the water and swam toward a raft. Explosions continued to roil the sea as the Corry slipped beneath the waves, leaving only the masts and part of the stern still visible.

But Hoffmann was not the last to leave. Stunned, he and the survivors saw an unknown man climb the Corry’s stern. The sailor removed the ship’s flag, which had been shot down, then swam to the main mast. He knew he was a target. Shells were falling all around him. The crew watched in awe as, despite this, the sailor “calmly tied on the flag and ran it up the mast” before swimming away.

No one knows who the sailor was or what happened to him. But we know what happened to flag. The mast continued to jut above the water. For a few seconds, the flag hung there. Then it stretched out. The Stars and Stripes rippled in the breeze. Refusing to succumb to the sea.

***

Next month marks the 80th anniversary of the D-Day landings. As we prepare to observe Memorial Day, we think it’s right that we remember a third flag flown over the beaches of Normandy.

Every morning, at the American Cemetery in Normandy, the American flag rises over the graves of those who fell on D-Day. They gave their lives to plant the flag. To defend the flag. And most of all, to ensure that what the flag stands for – freedom, liberty, justice, equality – would never be extinguished from the earth. We are so grateful for them. We know you are, too. So, this Memorial Day, let us all do our best to remember the words inscribed near that flag:

We have not forgotten, we will never forget, the debt of infinite gratitude that we have contracted with those who gave everything for our freedom.

On behalf of our entire team, we wish you a safe and peaceful Memorial Day.

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 Cornelius Ryan, The Longest Day: June 6, 1944. New York, Simon and Schuster, 1959.

A mother’s work is never done, never easy, and never celebrated enough. It’s not uncommon to hear people describe their mom as “The Best Mom Ever” and proudly present her with a personalized coffee cup or trophy. But for many people, Mother’s Day can be a difficult day, filled with emotion, struggle, and maybe even heartbreak. For that reason, this year we want to try to honor all the ways this complicated day affects people.

For some, this is your first Mother’s Day without your mom. We’ve heard so many stories of loss this past year and our hearts are with you as you find new traditions to continue celebrating the woman who gave you life. Whether you plant flowers in her honor, enjoy brunch at her favorite restaurant, or spend an afternoon on her favorite lake, we know she is in your thoughts on this day more than others.

For the moms of little ones who are wondering if the real gift might be some quiet time alone, we see you. We know you’re exhausted and have run out of ideas about what to cook for dinner. Know that you inspire us. This year, we send you all our restorative energy wishes and have our fingers crossed you get the nap you so greatly deserve.

For the moms who will be celebrating via Zoom because geography prevents a physical hug, we are ready and waiting to step into that gap. Every single person in our office has experienced this and we would love to meet you for coffee, hear about your kids’ adventures, and give you the hug they themselves aren’t able to deliver this year.

For the foster and adoptive moms who have committed to opening your hearts and homes, we believe you are single-handedly changing the world. Your love is making a difference in the most tangible way imaginable, and we are in awe of your willingness to risk – sacrifice, even! – your own comfort each and every day.

For the women who thought they’d be a mom by now, but that isn’t how life has played out, we know how heartbreaking this day can be for you. We know you may be tempted to stay home, avoid social media, and dodge the awkward sympathy that may come from well-meaning friends and family. You are not forgotten, and you are not invisible. Be encouraged to give yourself the self-care you need today, in whatever form that may be.

To the mommas whose babies are waiting for you in Heaven, we grieve with you. We know that however briefly you held them, they will always be in your heart. You are no less important on this day. We would not dare to suggest that we know all you have been through, or even begin to imagine the pain you have endured, so we won’t offer empty platitudes. But you are in our thoughts and hearts more than ever on this day.

And for those of you for whom this day evokes painful memories, we wish you nurturing relationships to help heal the hurts and mend your hearts.

Wherever your heart is this Mother’s Day, we want you to know we are grateful for you. We are here if you need a shoulder to cry on or an ear to speak to. We are looking forward to many years of celebrating life’s triumphs and heartaches with you as friends.

To all the women who have offered motherly wisdom and guidance into our lives, we want to wish you a very happy Mother’s Day.

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

Here at Hudock Capital Group, our team has a “watch list” of economic factors, market data, and ongoing storylines that we keep an eye on. Sometimes, we move some items up or down on the list, depending on the impact we expect them to have on the markets. By doing this, we can be proactive when making investment decisions…and we can also ensure that you stay current with what’s going on.

Recently, a few items have dominated our watch list that we want to update you on. While the markets have had a good year overall – the S&P 500 gained 10.2% in the first quarter alone1 – they were somewhat more volatile in April. That’s largely due to three factors: GDP, inflation, and what both mean for interest rates. So, with your April statement, soon to be in your hands, we figured it was a good time to explain how these factors are affecting the markets.

Let’s start with GDP, or gross domestic product. GDP is the value of all the goods and services produced in a given period. Typically, a rising GDP indicates a healthy, growing economy. Here in the U.S., GDP growth has been positive for seven consecutive quarters. In fact, on April 25, the U.S. Bureau of Economic Analysis reported that the economy grew by 1.6% in the first quarter of the year.2 But then a funny thing happened. When the news came out, the markets promptly slid.

Now, at first glance, this might seem counterintuitive. After all, isn’t the economy growing a good thing? If so, wouldn’t the markets go up on that news?

The daily movement of the markets is always driven by a variety of factors. In mathematics, we know that 1+1 always equals 2. In physics, we know that e=mc2. (Don’t ask us to explain why, though.) But the markets are not governed by consistent laws. They are driven by data, yes, but also by the context surrounding that data…and by the emotions that context provokes.

In this case – and likely for the near future – there is a lot of context to consider when trying to parse any economic data. In this case, the context is as follows:

While the economy expanded in Q1, that growth was much lower than economists thought it would be. Most had forecast the nation’s GDP – the value of all the goods and services produced in a given period – would rise by around 2.4%, not 1.6%.2 And the Atlanta Fed had estimated a 2.7% gain.3

This disparity between forecast and results was largely due to lower consumer spending. While spending did increase in Q1, to the tune of 2.5%, this was also lower than economists estimated.2 A small decrease in exports and a slight increase in imports also dragged GDP down for the quarter.

That brings us to the second factor, inflation. On the same day as the most recent GDP report, the BEA also reported new data suggesting inflation may remain “sticky” for the foreseeable future. The Personal

Consumption Expenditures (PCE) price index, which measures the change in the prices of goods and services purchased by all consumers in the U.S., rose by 3.4% in Q1. That’s a big jump from the 1.8% mark we saw in Q4 of 2023.2

Normally, the fact that the economy grew at all would still be cheered by investors, if for no other reason than what it might mean for the third factor: interest rates. As you know, the Federal Reserve has kept rates elevated for the past two years to help bring down inflation. Since higher rates typically lead to less borrowing and lower spending, they are effective at cooling prices down. But when the rate hikes began, many experts thought they would also cause the economy to decline.

So far, that hasn’t happened. So, investors figured that lower inflation, combined with a strong economy, would prompt the Fed to start lowering rates in the spring or early summer. (This expectation is one of the main reasons the stock market has performed so well over the last year.) But with inflation trending higher again, it’s now unlikely the Fed will cut rates anytime soon.

For investors, though, all this data suggests a new potential problem: stagflation.

While inflation is never easy, the pain has been cushioned somewhat by the fact that our economy has continued to grow at a healthy rate. But what if prices remain high while growth becomes stagnant? That’s stagflation. It’s rare, and to be clear, we’re still a long way from that. But Q1’s lower-than-expected GDP, combined with an uptick in inflation, now makes it a possibility our team has added to our “things to watch” list.

Now, it’s important, that we don’t overreact to any of this. While the markets move around like a motorboat, affected by every rock and wave, the overall economy turns like an aircraft carrier. The data we see from one quarter may not make its true effects known for months to come. So many outcomes are still in play. The economy may slow just enough to bring down inflation without stopping altogether. (That would be the Fed’s preference.) Finally, new factors may lead to the economy accelerating again in Q2 or Q3 while also keeping prices high. (In other words, a continuation of the status quo.) One lower-than-expected quarter is just a data point, not a guarantee of stormy waters. It’s important to keep an eye on it, but for now, our team will remain confident in our course.

For us, the key thing is to steel ourselves against an onslaught of data in the coming months that may seem counterintuitive or even contradictory. We must always do our best to put everything in context while being aware of the emotions that context provokes in us. By doing that — by keeping our emotions in check and not overreacting to every report or headline — we will be best positioned to remain on track to your long-term goals.

As always, we will keep you apprised of what’s going on in the markets and why. We are constantly monitoring the items on our watch list and will continue to do so. So, if you ever have any questions or concerns, we are always here to address them. Have a great month!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 “Stocks close out 2023 with a 24% gain,” CBS, www.cbsnews.com/news/stock-market-up-24-percent-2023-rally/

2 “GDP growth slowed to a 1.6% rate in the first quarter,” CNBC, www.cnbc.com/2024/04/25/gdp-q1-2024-increased-at-a-1point6percent-rate.html

3 “Stagflation fears just hit wall Street,” CNN Business, www.cnn.com/2024/04/26/investing/premarket-stocks-trading-pce-stagflation/index.html

Have you ever heard of the Magnificent 7?

No, we’re not referring to the classic western starting Yul Brynner and Steve McQueen. We’re referring to the seven companies most responsible for the stock market’s rise over the past year. In fact, they have played such an oversized role that it’s time to start thinking about what might happen if they were to…stop.

Many of our clients have been asking us about the Magnificent 7 lately. (The term is not an official one, of course. An investment analyst coined it last year and it quickly caught on.) So, in this message, we’re going to answer:

Six Important Questions About the Magnificent 7

Let’s start with:

- What exactly are the Magnificent 7 and why do they matter?

While we rarely mention specific companies when discussing the markets, we’re going to name them here. The Magnificent 7 are: Amazon, Alphabet (aka Google), Apple, Meta (aka Facebook), Microsoft, NVIDIA, and Tesla. Collectively, these companies have a greater market capitalization than all the combined companies in nearly every country in the world.1 In fact:

- In 2023, their market capitalization represented a staggering 29% of the entire S&P 500.2

- The stock prices of these companies rose by an average of 111% last year.2

- In January 2024 alone, just five of these seven stocks were responsible for 98% of the S&P 500’s gains for the month.3

When we zoom out and look at the stock market, we tend to see it as a single squiggly line. Sometime the line goes up. Sometimes it goes down. Sometimes, it zig-zags. But this isn’t really an accurate way to think of stocks. At any given time, some stocks will be moving up, and some will be moving down. If more stocks are moving in one direction than another – especially if they are weighted more heavily, which we’ll get into in a moment – then that’s what drives the overall direction of the market.

It’s uncommon, however, for such a small handful of stocks to affect the squiggly line so thoroughly. And that’s why the Magnificent 7 matters.

- Why are the Magnificent 7 having such an oversized impact?

Okay, bear with us here, because we’re about to get a little technical.

The S&P 500 is what’s known as a capitalization-weighted index. That means each of the 500 companies are weighted according to their market capitalization. This is a company’s share price multiplied by the number of shares available to buy or sell. As you know, some companies are simply bigger or do more business than others. Typically, this means they have more outstanding shares. A high number of shares plus a high share price leads to a higher market capitalization. This in turn means they have more weight within the S&P 500. The result? The price movement of these companies has a greater impact than that of smaller companies.

In an unweighted index, every company has the same impact, no matter its price or how many shares are available. The price of the index is determined by simply adding up every company’s stock price, then dividing by the total number of companies in the index. But in a weighted index, when some companies perform at a much higher or lower level than the average, they can push the entire index way up…or drag it way down.

Here’s another way to think of it. In 2023, the S&P 500 rose by 24%. If you gave each company in the index an equal weight, that number would drop to 12%.2 And if you took the Magnificent 7 out of the index entirely, that number would be only 8%.2

That’s how much weighting can matter.

- Okay, so why have the Magnificent 7 risen so much?

It helps that six of the seven are household names that just about everyone has heard of. They provide products and services that many people use every single day. (Cell phones, computers, the chips needed to power both, cars, delivery, etc.)

But the main reason for their current rise can be summed up in two words: artificial intelligence.

The last two years have brought some stunning advances to the field of AI. There are now a multitude of AI-driven products available. Many are designed to help companies boost productivity and increase efficiency. These advances have many investors salivating at the possibility that AI will help companies produce more than ever before…and in doing so, return more value to their shareholders. Many experts believe that AI could change the world similar to how the internet did.

Each of the Magnificent 7 are either heavily leveraging AI or are actually helping to advance it. Each is an already-successful company. Each has stellar brand recognition. And each is at the forefront of a potentially revolutionary new field.

- Does this mean we should put everything into these 7 stocks?

In a word? No. In two words? Absolutely not.

Let’s review some recent history. Before the Magnificent 7, the hot buzzword on Wall Street was “FAANG” stocks. (This was an acronym for Facebook, Amazon, Apple, Netflix, and Google.) In the late 2010s, these companies also represented a huge portion of the S&P 500. But over time, things changed. Facebook became Meta. Google became Alphabet. And companies like Tesla and NVIDIA grew to have a far greater market capitalization than Netflix.

Then, too, even these tech giants haven’t always been winners. For example, remember 2022? The S&P 500 lost 19.4% that year.4 The culprit? Tech. Many of the same tech companies that drove the markets in ’23 are what dragged the markets in ’22. (This includes the Magnificent 7.) Nobody, no matter how intelligent or experienced, has a crystal ball. Nobody knows how long the Magnificent 7 will stay magnificent…or which companies will eventually, inevitably, replace them.

This is why we are such believers in the concept of diversification. Because we don’t know, we don’t try to guess. Instead, we make sure we are positioned to take advantage of any sector, at any time, instead of taking the proverbial “eggs in one basket” approach.

- What does this all mean for the future?

Again, there’s no way to know for certain…but there are a few possibilities. One is that the market rally continues because the breadth of the rally increases. Rather than relying on just a few companies to propel it forward, the market instead enjoys a broader front, where more companies are rising in value at the same time. This indicates a healthier market. Earlier in the year, market breadth was narrowing – a bad sign. In recent weeks, however, that trend has started to reverse.5 More shares have been rising compared to those falling.

Another scenario is that things continue as they have. That’s probably not sustainable, however. Either more companies will catch up, or at least some of the Magnificent 7 will come back to earth.

There’s a third scenario we must always be on the lookout for: That the hype around AI represents a bubble. Remember the dot-com bust around the turn of the century? The rise of the internet created so much excitement that many net-based companies exploded in value…only to implode when it became clear their value was based more on hype than anything real. Right now, AI is an exciting new frontier. Only time will tell, however, whether that frontier is a real horizon or just a mirage.

- So why is it important to know about all this?

For two reasons. First, it reminds us that the “squiggly line” we see representing the stock market doesn’t always tell the full story. In this case, the line for 2023 and into 2024 looks impressive. But when you zoom in, you see the breadth of that line is remarkably skinny. While the stock market has undoubtedly done well, the majority of the market isn’t quite as impressive as it seems on the surface.

Second, it reminds us not to get caught up in the hype…or in headlines. The Magnificent 7 represent a group of exciting companies propelling the markets. That’s the story today. A story we definitely want to participate in. But what will the story be tomorrow? That is something we must never forget to consider…and always be prepared to face.

In The Magnificent 7 film, a group of gunfighters are hired to protect a small town from bandits. By the end of the movie, some of the group survived; others didn’t. As the survivors prepare to leave, the town leader tells them: “You’re like the wind…blowing over the land and passing on.”

In our experience, individual stocks are also like the wind. They blow over the land…and then they pass on. Our job is to be the land itself. Our job is to remain. And that is what we will always strive to help you do.

Please let us know if you have any questions – or if there is ever anything we can do for you!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 “Magnificent 7 profits now exceed almost every country in the world,” CNBC, www.cnbc.com/2024/02/19/magnificent-7-profits-now-exceed-almost-every-country-in-the-world-should-we-be-worried.html

2 “Magnificent 7 Lead Domestic Large Cap Outperformance,” Forbes, www.forbes.com/sites/greatspeculations/2024/01/22/2023-in-review/?sh=6d37f2fd690b

3 “Will the Magnificent 7 Keep Carrying the Market?” Morningstar, www.morningstar.com/markets/magnificent-seven-earnings-whats-ahead-biggest-players-stock-market

4 “S&P 500 finishes 2022 down nearly 20%,” CNBC, https://www.cnbc.com/2022/12/29/stock-market-futures-open-to-close-news.html

5 “Fear & Greed Index – Stock Price Breadth,” CNN Business, www.cnn.com/markets/fear-and-greed

For some people, St. Patrick’s Day is a celebration of their Irish heritage. For others, it is primarily a religious day. (It’s named, after all, for a legendary religious figure.) More recently, it has become a celebration of Irish culture in general. But many people don’t know that St. Patrick’s Day also plays an important role in American history. Specifically, with the American Revolution.

***

There have been few winters more brutal than that of 1779-1780. For the American soldiers of the Continental Army, conditions were even worse than they had been two years earlier at Valley Forge. Most of the army was camped near Morristown, New Jersey, buried under nearly six feet of snow. The soldiers had been struck by twenty-eight different snowstorms since the beginning of winter. There was a constant shortage of food and supplies. George Washington wrote that soldiers often had to go “five or six days together without bread, at other times as many days without meat, and once or twice, two or three days without either.”1 Smallpox was a constant threat. Few soldiers had adequate clothes. Most had not been paid in months.

Of the 8,000 troops in the camp, Washington estimated that as many as one-third were unfit for duty.

Despite these appalling conditions, duty never stopped. There was still a war to be fought. The men were so busy, they hadn’t even had the time to celebrate Christmas.

Washington knew something had to be done. The situation was so bad, and morale so low, that the entire army seemed on the verge of deserting. So, as winter went on, with no hope for an early spring, he began to look at a very specific date on his calendar:

March 17.

It was a well-chosen date. The day already had a tradition of being the anniversary of St. Patrick’s death. And the American army was an increasingly Irish-American army. Over 200,000 Irish people had emigrated to the colonies in the 18th century, the largest of any immigrant group.2 Many came from a long tradition of opposing British rule. As the Revolutionary War dragged on, more and more began volunteering for the Continental Army. Washington’s own aide was from Ireland, as were several of his subordinates. Of the rank-and-file, approximately 25% were either Irish-born or of Irish descent.3

Then, early in the year, news came through the camp of a possible armed revolt in Ireland. To the Americans, the idea of other kindred spirits fighting for their own liberty against the British was an inspiring one.

This convinced Washington the time was ripe to give his soldiers something they desperately needed: A holiday. And so, he selected March 17, 1780. St. Patrick’s Day.

“The general congratulates the army on the very interesting proceedings of Ireland and the inhabitants of that country which have been lately communicated; not only as they appear calculated to remove those heavy and tyrannical oppressions on their trade but to restore to a brave and generous people their ancient rights and freedom and by their operations to promote the cause of America. Desirous of impressing upon the minds of the army, transactions so important in their nature, the general directs that all fatigue and working parties cease for tomorrow the seventeenth, a day held in particular regard by the people of the nation.” 2 – George Washington, Proclamation, March 16, 1780

This was actually not the first time Washington turned to Ireland for inspiration. Four years before, he had watched British troops evacuate Boston after an eleven-month siege. It was his first major victory of the war. That day, Washington ordered that anyone wishing to re-enter the city must provide a password and countersign. The password: Boston.

The countersign? St. Patrick.

Back in 1780, the holiday was exactly what the Continental Army needed. One local newspaper reported that day was “…ushered in with music and hoisting of colors, exhibiting the 13 stripes, the favorite Harp, and an inscription declaring in capitals, THE INDEPENDENCE OF IRELAND.”4 There were parties of music and dancing throughout the camp. A Pennsylvania brigade was able to procure an entire barrel of rum. One Irish relief organization was so grateful to Washington that they named him an honorary member of their society.

Of course, the Revolutionary War still had several years left to go. But that one St. Patrick’s Day celebration helped the soldiers who secured our independence to rediscover their morale, spirit, and hope for the future. It was not only a chance for them to celebrate where they had come from. It was a chance to rededicate themselves to where they were going.

Today, St. Patrick’s Day is a celebration of Irish heritage and culture. But it’s also a chance for us as a country to do what our ancestors did: Raise our spirits, lift up morale, celebrate our past…and look forward to our future. This year, may we all do just that! So, on behalf of everyone at Hudock Capital Group, we wish you a very happy St. Patrick’s Day!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 “Washington’s Encampment at Morristown,” Battlefields.org, https://www.battlefields.org/learn/articles/washingtons-encampment-morristown-new-jersey-and-hard-winter-1779-1780

2 “Washington’s St. Patrick’s Day Proclamation of 1780,” Mount Vernon, https://www.mountvernon.org/george-washington/religion/a-brave-and-generous-people/

3 “George Washington’s Revolutionary St. Patrick’s Day,” History, https://www.history.com/news/george-washingtons-revolutionary-st-patricks-day

4 “St. Patrick’s Day 1780 in Jockey Hollow,” National Park Service, https://www.nps.gov/articles/000/stpatricksday1780.htm

Happy Valentine’s Day!

For many people, Valentine’s is the most romantic day of the year. But not everybody feels that way. Some people are single. Some are divorced. Some are widowed. Others don’t think the idea of spending money on flowers, chocolates, and fancy dinners is romantic at all and may resent the feeling that society “expects” them to do it.

In truth, though, the day is about far more than romance. It’s about showing others they are loved and appreciated. Recently, we came across several stories of people who are doing just that: Using Valentine’s Day to spread love in their communities and show appreciation to those who need it most. In honor of the holiday, we thought we’d share three of those stories with you.

At Rush University Medical Center in Chicago, many of the patients are veterans. Most of these wounded warriors are there for the long term. Some are injured in body, mind, and heart. Others are elderly and frail, their bodies finally on the verge of giving up the long fight.

All have dedicated their lives to serving their country.

So, every Valentine’s Day, a group of local teenagers take the time to show these veterans how much their service and sacrifice mean to the community. Working with the residents of a nearby senior living community, the teens craft Valentine’s Day gifts by hand. First, they paint dozens of bowls, then fill them with paper hearts and cranes. Each is carefully shaped, cut, and folded with as much care and love as possible.

The students were not the first to do this. The tradition started eight years ago with former students and has continued ever since. And they know they will not be the last.

According to the hospital staff, “It lets [the veterans] know we love them, and we appreciate them. When they get these [Valentines], it really warms their heart.”1

And as one gift giver put it: “By showing love for other people, we can be their Valentine in a way.”1

***

When it comes to showing love, nothing on Earth shows it better than a dog. That’s why, in the Philippines, some people choose to spend Valentine’s Day giving love back.

Every Valentine’s Day in Manila, an animal shelter charges guests about $10 to spend half an hour with a rescue dog. Many of the dogs came from abusive households or experienced trauma. The fee goes to running the shelter, which cares for over 240 dogs and cats. The guests can choose one or more dogs to walk and play with, and many will choose to adopt their new furry friend. But all the dogs benefit, because it helps them relax, improve their social skills…and yes, feel more loved.

Says one of the caretakers: “A lot of animals in the shelter can give all the love that they can give, but they aren’t given a chance.”2 But now, many dogs will get that chance.

Thirty minutes with a dog. Who could ask for a better date on Valentine’s Day?

***

As you know, few gifts are as romantic as flowers – making Valentine’s like Christmas for the floral industry. In fact, 250 million flowers are sold around the world every Valentine’s Day!

For some people, though, Valentine’s Day doesn’t trigger feelings of romance, but of loneliness. This is especially true for those who have lost their spouse or partner. Back in 2021, a florist in North Carolina decided it was time those people felt loved around the holiday, too.

It all began when the florist, Ashley, delivered a bouquet to her son’s preschool teacher as a gift. It meant so much to the teacher that Ashley started thinking about others who might enjoy a similar gift. With the help of some volunteers, Ashley decided to deliver free flowers to widows in her community. Using Instagram to get the word out, Ashley built a list of 125 people.

The next year, that number increased to 800.

Since then, Ashley has raised $50,000 and recruited over 1000 volunteers to help make Valentine’s Day special to those who have lost their spouse or partner. The initiative has become so popular that she no longer does regular business on Valentine’s Day. Instead, she spends that time knocking on doors and delivering flowers to those who least expect them…and most appreciate them.

“It’s a total surprise, and [at first] there is a lot of confusion,” Ashley says. “But on a day that may be sad, you open your door, and there’s a young person there with a bouquet and gifts saying, ‘We just want you to know you’re loved today and every day.’ We flipped the script and turned it into a holiday that is not just for people who are married or have a partner to celebrate with. When we see the smiles on people’s faces, it’s encouraging to know there are a lot of good people in this world, and it takes one movement to create a ripple effect.”3

To us, these stories prove that Valentine’s Day isn’t just for romance, as fun as that can be. It’s a day for spreading love throughout our community. A day for letting those around us know they are appreciated, valued, and seen. And that, to us, makes it a special day indeed. So, on behalf of everyone here at Hudock Capital Group, we want you to know how much we value and appreciate you. Have a wonderful Valentine’s Day!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

1 “For Valentine’s Day, Chicago teens, seniors spread love with veterans,” CBS News, www.cbsnews.com/chicago/news/valentines-chicago-veterans/

2 “Animal lovers book Valentine’s with shelter dogs,” Reuters, www.reuters.com/lifestyle/philippines-animal-lovers-book-valentines-dates-with-shelter-dogs-2023-02-14/

3 “Charlotte florist gives flowers to widows on Valentine’s,” CBS News, www.cbsnews.com/news/valentines-day-flowers-charlotte-florist-widow/?intcid=CNM-00-10abd1h

Every January, it’s customary to look back on the year that was. What were the highlights? What were the “lowlights”? What events will we remember? Most importantly, what did we learn?

As you know, many noteworthy and historic events happened in 2023. Conflicts in Gaza, Ukraine, and Sudan. India surpassed China as the most populous country in the world. New temperature records were set all around the globe. The use of “artificial intelligence” exploded and turned multiple industries on their heads. Chinese spy balloons and deep-sea submarines grabbed the headlines. The “Barbenheimer” phenomenon reinvigorated Hollywood.

But in some ways, one of the most notable occurrences of 2023 is actually what didn’t happen: We never entered a recession.

When 2023 began, the fear of a recession was so widespread that it almost seemed inevitable. According to one survey, 70% of economists expected a recession to hit the U.S. in 2023.1 Another survey found 58% of economists believed there was a more than 50% chance of a recession. 1 For politicians, pundits, and analysts, it was practically all they could talk about.

But it never happened. Instead, the economy grew by 2.2% in the first quarter, 2.1% in the second, and 4.9% in the third.2 (As of this writing, the numbers for Q4 are not yet available, but it’s expected to go up again.) None of this is to say that our economy is perfect, or that we won’t have a recession in the future. But for 2023, all the gloomy forecasts simply didn’t come to pass.

Now, let’s be fair to all those economists who got it wrong: They had very good reasons for expecting a recession. Reasons based on data, logic, and history.

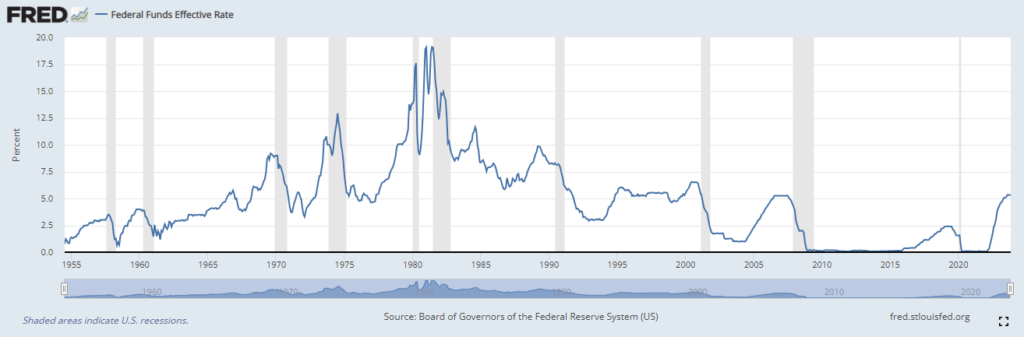

You see, when the year began, the U.S. was coming off a nasty 2022. While consumer prices were already coming down from their earlier highs, the national inflation rate was still 6.5%.3 Interest rates, meanwhile, had risen dramatically, from just above 0% at the beginning of 2022 to over 4% by the end.4 It was already the highest level we’d seen in fifteen years – just before the Great Recession, in fact – and every indication was that rates would continue to rise higher. All this economic pain was reflected in the stock market. The S&P 500, for example, dropped over 19% in 2022.5

For economists, all this data seemed to point a clear way forward. The Federal Reserve is mandated to keep consumer prices as stable as possible. (Its target has long been to hold inflation to around 2%.) When inflation runs hot, the Fed’s main tool for lowering it is to raise interest rates. Higher rates often lead to lower consumer spending. Lower spending, in turn, prompts businesses to decrease the cost of the goods and services they provide. Essentially, higher rates create an environment where supply is greater than demand, thus cooling inflation.

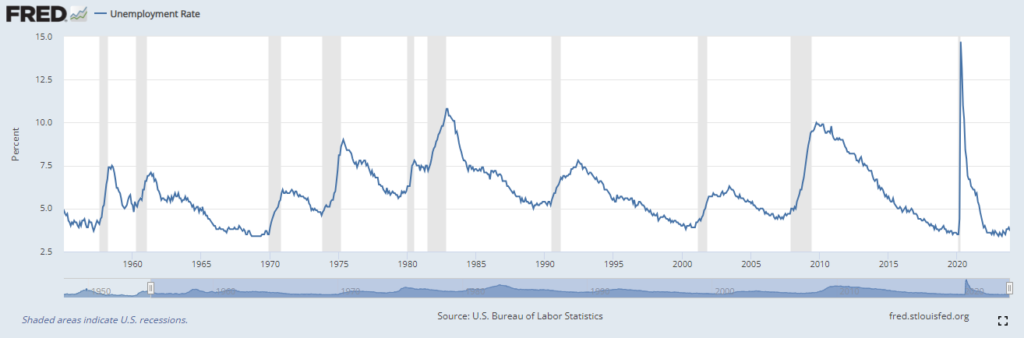

But there’s a side effect to this. If spending drops too much, businesses are often forced to cut back on expansion, investment, and labor costs. This leads to a rise in unemployment…and a contracting economy. In short, a recession.

This string of events isn’t just logical. It’s supported by history. When inflation has skyrocketed in the past, the Fed’s playbook has usually worked to bring prices down…but it’s usually triggered a recession, too. Economists call this a “hard landing.”

Take a look at these two charts. The top shows interest rate levels since 1955.3 The gray bars indicate a recession. Notice how often a gray bar appears in the aftermath of a sharp rise in rates? Similarly, the bottom chart shows the unemployment rate.6 See how the gray bars always coincide with a major spike in unemployment? It’s clear that, historically, fast-rising rates often trigger a rise in unemployment…which contributes to a recession.

What about when prices come down, but the economy does not? Economists call that a soft landing, and it’s proven to be very difficult to achieve. It’s no surprise, then, that most economists predicted a hard landing in 2023.

One year later, that hasn’t happened. Interest rates did continue to rise. As of this writing, they’re at 5.3%.4 Inflation has continued to cool, albeit slowly. As of November, the inflation rate was 3.1%. That’s a 3.4% drop from the beginning of the year.3 But consumer spending has remained steady. The labor market has remained strong. The unemployment rate was only 3.7% as of November.6 And, as we’ve already covered, the economy has continued to grow.

From a financial standpoint, this, to me, is the major storyline of 2023. Which means we have to ask ourselves: “What can we learn from it?” As your financial advisors, we’ve taken the time to jot down a few lessons we think are worth remembering as we move into the New Year. Here they are:

#1: Always emphasize preparation over prediction. The economists who predicted a recession weren’t stupid. They used the best data they had to make the best predictions they could. But 2023 shows that even the most well-informed people simply can’t see the future. Even the near future! There are simply too many variables to consider. That’s why, as investors, we have to always emphasize planning over predicting. We can’t predict when the markets will drop nearly 20%, as they did in 2022.5 Or, when they’ll rise by well over 20%, as they did in 2023.5 What we can do is plan ahead for what we’ll do if the markets fall, or if they rise. We can prepare mentally and financially for both market storms and market sunshine. So that we can weather the former and take advantage of the latter.

When we predict, we’re essentially swinging for the fences on every pitch. Occasionally, a prediction can lead to a home run…but it can also lead to a lot of strike outs. By planning, we don’t have to swing at all. Since we can’t control the situation, we simply make the best out of every situation. We control only what we can control – ourselves.

#2: Be wary of confirmation bias. Earlier in the year, many people were convinced a recession would happen. Because of that, they tended to disregard all data that pointed away from a recession, and only valued information that confirmed what they already believed. As a result, many investors missed out on a stellar year in the markets! This is another example of why preparing is so much better than predicting. It removes emotion from our decision-making. Because we’re not so focused on “being right,” we can focus instead on “being ready!”

#3: Remember that past performance is no guarantee of future results. You’ve probably seen this line in the past, and 2023 is a great example of why. Just because rising interest rates have led to recessions in the past doesn’t mean they always will. Just because the markets went one direction yesterday doesn’t mean they’ll go the same direction tomorrow. While history is a great resource to draw from when making decisions, it’s just a guide, not a guarantee.

#4: At the same time, don’t anchor to the present. As humans, we have a natural tendency to think that the way things are today is how they’ll be tomorrow. When 2022 ended, many investors felt that 2023 would be much the same. Now, we run the risk of thinking that just because a recession didn’t happen last year, it won’t happen this year.

Again, it all goes back to planning and preparation. Here at Hudock Capital Group, we will continue to prepare for all possible outcomes. We’ll plan for how to reach the outcomes we want and avoid the ones we don’t. But instead of predicting, instead of assuming, instead of anchoring, we will accept that the future is written in clay, not stone. Only when it becomes the past does it harden. So, when you get right down to it, the lesson of 2023 is this: The future is flexible, and so we must be flexible, too. By doing this, we can continue shaping your future into whatever it is you want it to be.

So, that’s 2023! We hope it was a wonderful year. On behalf of our entire team, we look forward to making 2024 even better. Have a Happy New Year!

Sincerely,

Barbara B. Hudock CIMA®, CPM®

Chief Executive Officer

Founding Partner

Michael J. Hudock, Jr., CPM®

President and Founding Partner

Wealth Consultant

SOURCES:

1 “Top US economists are often wrong – should we trust their predictions?” The Guardian, www.theguardian.com/business/2023/nov/19/us-economists-wrong-predictions

2 “Annualized growth of real GDP in the United States,” Statista, www.statista.com/statistics/188185/percent-change-from-preceding-period-in-real-gdp-in-the-us/

3 “United States Inflation Rate,” Trading Economics, https://tradingeconomics.com/united-states/inflation-cpi

4 “Federal Funds Effective Rate,” St. Louis Fed, https://fred.stlouisfed.org/series/FEDFUNDS

5 “S&P 500 Historical Annual Returns,” Macrotrends, https://www.macrotrends.net/2526/sp-500-historical-annual-returns

6 “Unemployment Rate,” St. Louis Fed, https://fred.stlouisfed.org/series/UNRATE