Letters category: Siegel

Categories

Despite Market Downdraft, Fed to Hike Next Week

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Labor Report Confirm Fed Move; ECB Miscommunication

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Economy Remains Steady; Friday’s Payrolls will Decide Fed

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Fed Ready to Raise and Acknowledges Lower Long-run Rates

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Markets Test Fed; Earnings in Tailspin

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Blockbuster Payroll Gains (Almost) Guarantee Fed Rate Hike

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

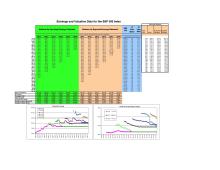

Estimated 2015 operating earnings of the S&P 500 dropped nearly $2 last month to $109.11 after firms, although beating Q3 estimates, gave downward guidance on Q4 earnings. If these earnings are realized, 2015 earnings will be almost 4% under 2014 levels and not far from 2013 levels. At a closing S&P last night of 2079, this puts the market at 19.0 times 2015 earnings. 2016 earnings estimates also fell, but are probably still too high at $126.95. One can see from the graphs below that the fall in estimated operating and reported earnings is the most rapid by far in recent years.

Investor sentiment has understandably rebounded from 7 year low reached last month and now stands at -13.5. Stocks are only a few percent from their highs, but there is still enough bearishness to spur a rally if the profit outlook improves.

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Fed is Ready for December and so are the Markets

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Enough of the Fed! Slow Growth and Low Inflation Keeps Rates Low

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.

Earnings Should Bounce in 2016; More Thoughts on the Productivity Collapse

Written by Jeremy Siegel. Reprinted with permission from Jeremy Siegel. Redistribution is prohibited.